As a teenager, managing money may seem like a daunting task, especially when balancing school, social life, and other responsibilities.

However, developing good financial habits early on can set you up for success in the future.

Whether you’re saving for a big purchase, preparing for college, or simply looking to build your financial independence, here are some practical tips to help you save money effectively:

Set Clear Goals:

Start by defining your financial goals. Do you want to save up for a new smartphone, a car, or perhaps your college tuition? Having specific goals in mind will motivate you to save and make it easier to track your progress.

Track Your Spending:

Keep track of your expenses by writing them down in a notebook or using a budgeting app on your smartphone. This will help you identify where your money is going and where you can cut back.

Create a Budget:

Once you know how much you’re spending, create a budget that allocates your money towards different categories such as savings, entertainment, and personal expenses. Be realistic and flexible with your budget, adjusting it as needed.

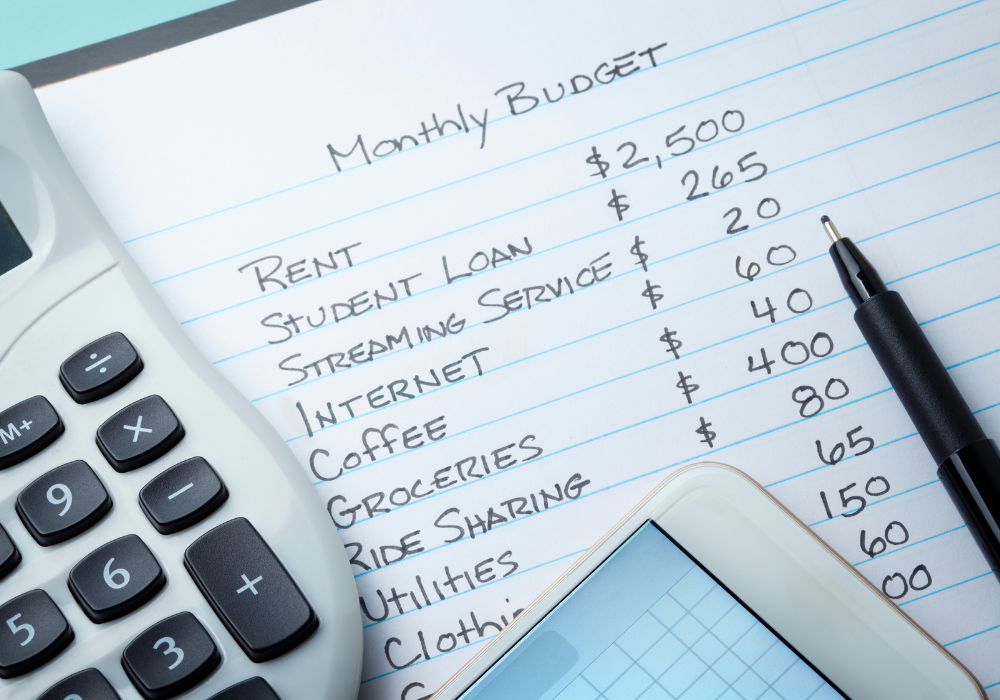

Utilizing a monthly budget allocation sheet can prove beneficial and encourage adherence to the plan.

Here is an example of a simple money budget allocation sheet.

Teenager Budget Allocation Sheet

Month: [Insert Month]

Total Income: $_____________ (Include allowance, part-time job earnings, gifts, etc.)

Expenses:

- Savings:

- Goal: $_____________ (Set a specific savings goal for the month)

- Actual: $_____________ (Record the amount you actually save)

- Personal Expenses:

- Description: $_____________ (Allocate funds for personal spending such as clothes, accessories, hobbies, etc.)

- Entertainment:

- Description: $_____________ (Allocate funds for entertainment expenses such as movies, concerts, video games, etc.)

- Transportation:

- Description: $_____________ (Allocate funds for transportation expenses such as bus fare, fuel if you have a car, etc.)

- Food:

- Description: $_____________ (Allocate funds for groceries, eating out, snacks, etc.)

- Miscellaneous:

- Description: $_____________ (Allocate funds for any other miscellaneous expenses)

Total Expenses: $_____________ (Sum of all allocated expenses)

Remaining Balance: $_____________ (Total Income – Total Expenses)

Save a Portion of Your Allowance or Income:

Whether you receive a weekly allowance, income from a part-time job, or monetary gifts for special occasions, make it a habit to save a portion of it. Aim to save at least 10-20% of your earnings each time you receive money.

Avoid Impulse Purchases:

Before making a purchase, especially for non-essential items, take a moment to consider whether it’s something you really need or just something you want in the moment. Avoid impulse buying by giving yourself time to think it over.

Shop Smart:

Look for sales, discounts, and coupons when shopping for clothes, gadgets, or other items. Consider buying gently used or refurbished items instead of brand new ones to save money without sacrificing quality.

Pack Your Own Meals:

Eating out can quickly eat into your budget. Save money by packing your own lunches and snacks for school or work instead of buying food from cafes or restaurants. Not only will you save money, but you’ll also likely eat healthier.

Limit Unnecessary Expenses:

Cut back on unnecessary expenses such as premium streaming services, video game microtransactions, or daily coffee runs. Small expenses can add up over time, so be mindful of where your money is going.

Explore Free or Low-Cost Activities:

Instead of spending money on expensive entertainment, look for free or low-cost activities to enjoy with friends and family. This could include hiking, picnics in the park, or game nights at home.

Save Windfalls and Gifts:

Whenever you receive unexpected money, such as a birthday gift or a bonus from work, consider saving a portion of it instead of spending it all at once. This will help you grow your savings faster and reach your goals sooner.

Remember, saving money as a teenager is not about depriving yourself of fun or luxuries, but rather about making smart choices with your finances.

By developing good saving habits early on, you’ll be better prepared to handle larger financial responsibilities in the future and achieve your long-term goals.

So start saving today and watch your money grow!